Integrity-Based Trust Measurement (IBTM)

Trust is your most valuable intangible asset, yet it is often managed with guesswork. This advanced toolkit is designed to fix that. It provides a comprehensive framework and a validated library of survey questions to move beyond indirect proxies (like satisfaction scores) and directly measure the three core drivers of stakeholder trust: Competence, Benevolence, and Integrity. Use this tool to transform "trust" from an abstract concept into a tangible Key Performance Indicator (KPI), allowing you to manage your reputation and relationships with the same rigor and lucidity you apply to your financial performance.

Part 1: Tool Blueprint & Overview

This section outlines the foundational design, philosophy, and components of the toolkit.

1.1. Primary Objective

To provide a structured methodology and a validated set of questions to quantitatively measure stakeholder trust. The goal is to transform "trust" from an abstract concept into a key performance indicator (KPI) that can be tracked over time, providing the board and leadership team with a clear, data-driven view of this critical intangible asset. This allows the organization to manage its reputation and relationships with the same rigor it applies to its financial performance.

1.2. Key Components

A. The IBTM Framework Guide: A short guide that explains the academically recognized drivers of trust (e.g., Competence, Benevolence, Integrity) and provides a methodology for deploying trust surveys and analyzing the results. (Content detailed in Part 2).

B. A Library of Survey Questions: A bank of validated survey questions, tailored for different key stakeholders (specifically employees and customers), designed to measure their perception of the company's trustworthiness across the core drivers. (Content detailed in Part 3).

1.3. Core Concepts of the Toolkit

1. Trust as a Leading Indicator: The core concept is that stakeholder trust is a powerful leading indicator of future financial performance. High customer trust leads to loyalty, repeat business, and greater pricing power. High employee trust leads to higher engagement, lower turnover, and greater innovation. A decline in trust is an early warning signal of future business challenges. Measuring trust, therefore, is a form of strategic foresight, allowing leaders to anticipate and address issues before they show up in the financial statements.

2. Measuring the Drivers of Trust: Trust is not a single feeling; it is a multi-faceted judgment. This toolkit is based on a classic model that breaks trust down into three distinct components:

Competence: "Are you good at what you do?" (Do you deliver a quality product/service?)

Benevolence: "Do you have my best interests at heart?" (Do you care about me beyond the transaction?)

Integrity: "Do you do what you say you will do?" (Are you honest and reliable?)

To improve trust, you must first understand which of these drivers is weakest. A company that invests heavily in improving its product (competence) when its real problem is a lack of care for its customers (benevolence) is wasting its resources and will not succeed in rebuilding trust.

Part 2: The IBTM Framework Guide

This guide provides the methodology and definitions needed to use the survey questions in Part 3 effectively. It explains the "why" behind the questions and how to turn the data into insight.

2.1. A Deeper Dive: The Three Drivers of Trust

Trust is the confident belief that another party will act in a way that is beneficial or, at a minimum, not detrimental to your own interests. Decades of research show that this belief is built on three distinct pillars. A weakness in any one of these pillars can cause the entire structure of trust to collapse.

1. Competence (The "Can You?" question):

Definition: This is the belief in an organization's ability to perform its function effectively and reliably. It's the foundation of credibility. For a customer, this means the product works as advertised. For an employee, it means leadership has a viable strategy and the skills to execute it.

Why it matters: Without competence, benevolence and integrity are irrelevant. If you don't believe a company can deliver a quality product, it doesn't matter if they are nice or honest. A failure in competence is a failure to deliver on the basic promise of the business.

2. Benevolence (The "Will You?" question):

Definition: This is the belief that the organization has a genuine concern for your well-being, beyond its own self-interest. It's the feeling that the company "has your back." For a customer, it's the sense that the company wants them to succeed, not just to make a sale. For an employee, it's the belief that leaders care about them as people, not just as resources.

Why it matters: Benevolence is what creates loyalty. Competence might win a transaction, but benevolence wins a long-term relationship. It's the primary driver of discretionary effort from employees and brand advocacy from customers. It provides a "cushion" of goodwill that helps a company weather a crisis.

3. Integrity (The "Do You?" question):

Definition: This is the belief that the organization adheres to a set of principles that you find acceptable. It is about the alignment of values and the reliability of their promises. It's the perception that the company is honest, fair, and that its actions are consistent with its words.

Why it matters: Integrity is the ultimate foundation. A competent and benevolent organization that is not perceived as honest or reliable will always be viewed with suspicion. Integrity is the glue that holds the other two pillars together. A single act of dishonesty can destroy years of goodwill built through competence and benevolence.

2.2. Methodology: Deploying a Trust Survey

Select Your Audience & Questions: Choose the stakeholder group you want to measure (e.g., Employees or Customers). Select a balanced set of 6-9 questions from the Library in Part 3, ensuring you have 2-3 questions for each of the three drivers of trust.

Ensure Anonymity: For employee surveys in particular, it is absolutely critical that responses are anonymous and confidential. Use a trusted third-party survey platform if necessary. Clearly communicate this commitment to anonymity to encourage honest feedback.

Set a Baseline: The first time you run the survey, the goal is to establish a clear baseline score for each of the three drivers. This will be your starting point.

Administer Annually: Trust is a long-term asset. We recommend administering the IBTM survey on an annual basis to track trends over time. This allows you to see if your strategic initiatives are having a measurable impact on trust.

2.3. Analysis: Turning Data into Insight

Once you have the survey results, the goal is to identify your biggest strengths and your most significant opportunities.

Calculate an Overall Trust Score: Calculate the average score across all questions to get a single "Net Trust Score." This is a useful high-level KPI for your Board-Level Integrity Dashboard.

Calculate Sub-Scores for Each Driver: More importantly, calculate the average score for the questions in each of the three categories (Competence, Benevolence, Integrity).

Identify Your Weakest Pillar: Compare the three sub-scores. The lowest score indicates your biggest vulnerability and your highest-leverage opportunity for improvement.

2.4. Interpreting Your Scores & Taking Action

A score is just a number. The value comes from turning that number into a clear diagnosis and a focused action plan. Use this guide to interpret your results.

Interpreting the Scores (on a 1-5 scale):

✅ Green Zone (4.0 - 5.0): A Clear Strength

What it means: Stakeholders have a strong, positive perception in this area. This is a source of strength for your brand and culture.

What to do: Your goal is to reinforce and celebrate what's working. In your communication with the team or customers, specifically highlight these strengths and the behaviors that are driving them.

⚠️ Yellow Zone (3.0 - 3.9): An Opportunity Area

What it means: The results are mixed. Some stakeholders likely have a positive experience, while others have a negative one. This inconsistency creates uncertainty and risk.

What to do: This is your primary area for focused improvement. Your goal is to understand the root cause of the inconsistency and take targeted action. This is where you should invest your energy.

🚩 Red Flag Zone (Below 3.0): An Urgent Priority

What it means: A score in this range indicates a significant trust deficit. A meaningful portion of your stakeholders feels that you are failing them in this dimension. This is a serious vulnerability that can damage your reputation and business performance.

What to do: This requires immediate attention and intervention. The goal is to triage the problem, understand its severity, and launch a clear, visible action plan to address it.

How to Prioritize Your Actions:

Address Red Flags First: Any score in the Red Flag Zone automatically becomes your #1 priority, regardless of the other scores. A significant trust deficit in any single driver can undermine the entire relationship.

Focus on Your Weakest Pillar: If all your scores are in the Green or Yellow zones, your priority should be the driver with the lowest score. This is your highest-leverage opportunity for improvement. For example, if your scores are Competence (4.5), Integrity (4.1), and Benevolence (3.1), your clear priority is to launch initiatives that demonstrate your care and concern for your stakeholders (Benevolence).

Communicate and Act: Once you have your priority, communicate it transparently to the relevant stakeholders. Say, "Based on your feedback, we've learned that we need to improve in [Area]. Here is the first step we are taking..." Acting on the feedback is the most powerful way to build trust.

Part 3: A Library of Survey Questions

This section provides a bank of validated questions to measure trust. Select 2-3 questions from each category for your chosen stakeholder group to create a short but powerful survey. All questions should be answered on a 5-point Likert scale (1 = Strongly Disagree, 5 = Strongly Agree).

3.1. Employee Trust Survey Questions

Category: Competence (Trust in Leadership's Ability)

1. I am confident in our leadership's ability to achieve our company's strategic goals.

2. Our leadership team has the skills and expertise needed to navigate future challenges.

3. This company makes sound decisions about its business and its future.

Category: Benevolence (Trust in Leadership's Care & Concern)

4. I believe our leaders genuinely care about my well-being as a person, not just as an employee.

5. When difficult decisions are made, I trust that our leaders have considered the impact on employees.

6. I feel safe in this organization; I believe the company has my back.

Category: Integrity (Trust in Leadership's Character & Reliability)

7. Our leaders act in a way that is consistent with the company's stated values.

8. I trust our leaders to communicate with us honestly, even when the news is difficult.

9. I believe that our leaders keep their promises and commitments.

3.2. Customer Trust Survey Questions

Category: Competence (Trust in the Company's Products/Services)

1. This company has a high level of expertise in its field.

2. This company's products/services are reliable and of high quality.

3. I am confident that this company can deliver on what it promises.

Category: Benevolence (Trust in the Company's Intentions)

4. I believe this company has my best interests at heart.

5. This company is committed to my success, not just to making a sale.

6. If I had a problem, I am confident this company would do the right thing to resolve it.

Category: Integrity (Trust in the Company's Principles & Reliability)

7. This company is honest and transparent in its communications with me.

8. I believe this company's actions are consistent with its stated values.

9. This company keeps its promises and commitments to its customers.

Part 4: A Strategic Guide to Rebuilding Trust

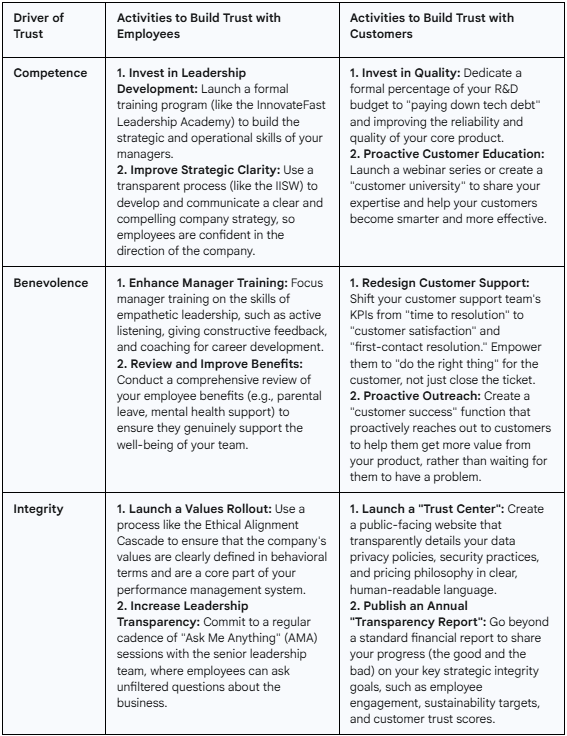

Once your survey has identified your weakest pillar of trust, use this guide to find concrete, high-impact activities to address it. This is not an exhaustive list, but a starting point for your strategic planning.

4.1. Communicating Your Results with Integrity

How you share the results of a trust survey is your first opportunity to build trust.

Be Transparent: Share the high-level results—both the good and the bad—with the surveyed group. Hiding the negative results is a violation of integrity and will destroy trust.

Take Accountability: As a leader, take ownership of the results. Use "we" and "I," not "you." For example: "The results show that we have an opportunity to improve in how we demonstrate care for our employees."

Make it a Dialogue: Don't just present the data. Use it to start a conversation. Ask: "The data suggests we are weak in Benevolence. What does that feel like to you? What are some of the things that might be causing that perception?"

Commit to Action: End the conversation by making a clear commitment: "Thank you for this feedback. Based on this, our leadership team is committing to [Action 1] and [Action 2]. We will report back on our progress at the next all-hands meeting."

4.2. A Deeper Dive into Improvement Activities

4.3. Integrating Trust into Your Strategic Rhythm

The IBTM survey is not a standalone event; it is a key data input for your ongoing strategic management process.

Board-Level Oversight: The "Net Trust Score" and the scores for each of the three drivers should be a standing item on the quarterly Board-Level Integrity Dashboard.

Strategic Planning: The annual results of the IBTM survey should be a key input for your Integrated Impact Strategy Workshop (IISW), providing a clear, data-driven picture of your relationship with your key stakeholders.